In the example shown the formula in C10 is. In the formula B2 is the annual loan interest rate B212 will get the monthly rate.

Excel Formula Estimate Mortgage Payment Exceljet

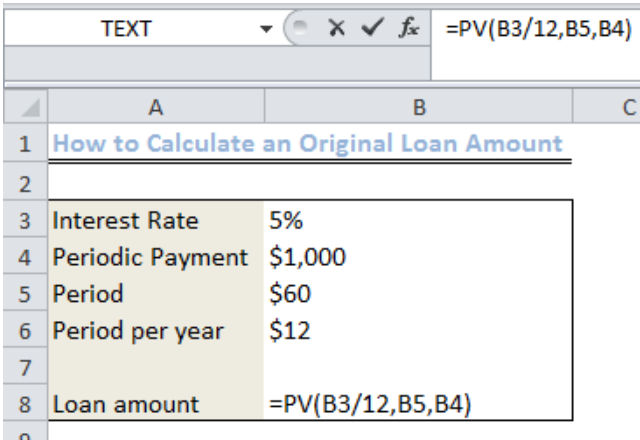

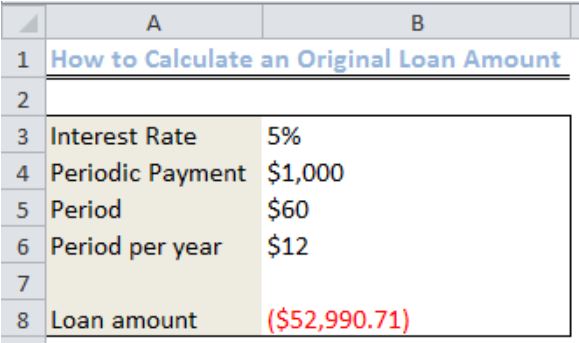

To calculate the original loan amount given the loan term the interest rate and a periodic payment amount you can use the PV function.

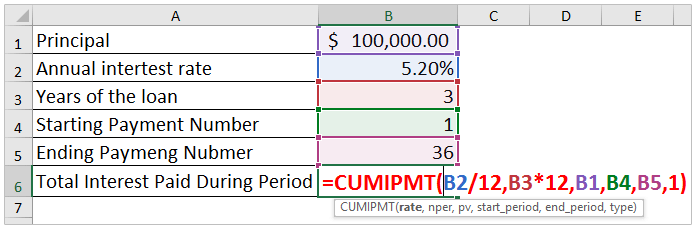

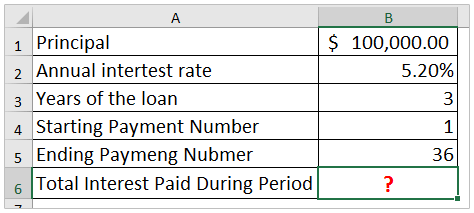

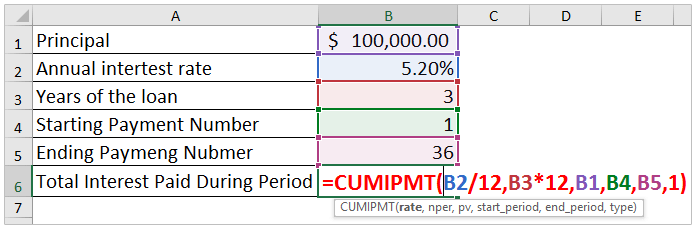

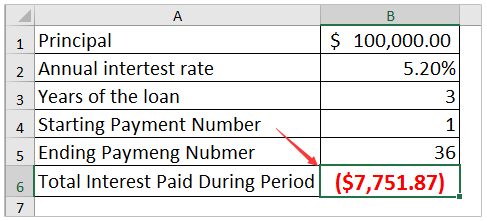

Excel formula total loan amount. The total amount to be repaid in a loan is a combination of the initial amount borrowed and the total amount of interest to be added excel can very easily calculate the total amount to be paid using the PMT function. PV C5 12 C7 C6. Select the cell you will place the calculated result in type the formula CUMIPMT B212B312B1B4B51 and press the Enter key.

Take the original loan date less todays date. Find the number of payments remaining. To calculate the total interest for a loan in a given year you can use the CUMIPMT function.

B1 is the. To calculate the periodic interest rate for a loan given the loan amount the number of payment periods and the payment amount you can use the RATE function. CUMIPMT C6 12 C8 C5 1 60 0.

The principal amount each period is equal to the loan amount divided by the total number of periodic payments. This is the amount we will pay for each month within the four-year period. Interest payment at time Period.

If we borrow 100000 for 10 years at 8 per cent annual percentage rate what is the total cost of the loan principal plus interest. In the example shown the total interest paid in year 1 is calculated by using 1 for start period and 12 for end period. PdRate Loan- Period-1PrinPmt The amount of the interest payment for a specified Period is equal to the balance of the loan for the previous period multiplied by the periodic interest rate.

To calculate how much money you will find in your bank account at the end of 3 years simply copy the same formula to column E and you will get 1225. For example a 30-year mortgage paid monthly will have a total of 360 payments 30 years x 12 months so you can enter 3012 360 or the corresponding cell in this case C412. In other words to borrow 120000 over 13 years to pay 960 monthly we should.

Using the function PVrateNPERPMT 19000-PV2912 312-350 the down payment required would be 694648. The 19000 purchase price is listed first in the formula. First use the rate formula to find your rate.

Solving For Loan Cost Total Use the above formula to determine the total amount you will pay for a loan. 24389075 and find that the total amount equals 12194535. In the example shown we calculate the total principal paid over the full term of the loan by using the first and last period.

PV B312B5B4 We will type or copy and paste this formula into Cell B8. If you wanted to calculate a five-year loan thats paid back monthly you would enter 512 or 60 for the number of periods. This amount covers only the principal which we collected and the interest.

In this formula the result of the PV function is the loan amount which is then subtracted from the purchase price to get the down payment. Those of you who have some experience with Excel formulas have probably figured out that what the above formula actually does is multiplying the initial deposit of 10 by 107 three times. The The formula in F5 is.

In the example shown the formula in C10 is. RATEnumber of payments cell payment amount cell - original loan value cell balloon payment cell x 12 note that original loan value is negative and you multiple by 12 to make it annual. CUMIPMT5 1260300001120.

To calculate a loan payment amount given an interest rate the loan term and the loan amount you can use the PMT function. In the example shown the formula in C10 is. In our case wed use this equation.

Inserting the Formula to Calculate the Original Loan Amount. Loan period in years the term of the loan in years Start date of loan the day when the payments for the loan will begin Monthly payment the total amount youll be paying monthly for the duration of the loan Number of payments total number of paymentsinstallments. B3 is the years of the loan B312 will get the total number of periods months during the loan.

How to use PMT function in Excel - formula examples. To calculate the total amount paid for the loan multiply the returned PMT value by the number of periods nper value. 1 The rate r would be 8 divided by 1200.

We use the formula 1 B5 is 12-1 1 0294 12-1 to obtain the annual rate of our loan which is 358. RATEC7 C6 - C5 12. Total Amount of a Loan Using Excel Microsoft Excel can be easily used to calculate the total amount of a loan to be repaid.

The formula in C10 is. PMT C6 12 C7 - C5.

How To Calculate Total Interest Paid On A Loan In Excel

Excel Formula Calculate Original Loan Amount

How To Calculate Loan Payments Using The Pmt Function In Excel Youtube

Excel Formula Calculate Original Loan Amount

How To Calculate Total Interest Paid On A Loan In Excel

Excel Formula Calculate Original Loan Amount Exceljet

Excel Pmt Function To Calculate Loan Payment Amount

Excel Formula Calculate Loan Interest In Given Year Exceljet

How To Calculate Total Interest Paid On A Loan In Excel

Tidak ada komentar:

Posting Komentar